Instant Loan Without Cribil Score|Instant loan online

क्या आप घर बैठे लोन लेना चाहते हैं कोई भी कंपनी आपको लोन नहीं दे रही है |

तो टेंशन फ्री हो जाइए क्योंकि आज आप लेने वाले हैं instant loan लेने वाले हैं घर बैठे |

जी हां दोस्तों आप घर बैठे पर्सनल लोन ले सकते हैं अपने मोबाइल फोन से |

क्योंकि आज मैं आपके लिए एक ऐसी फाइनेंस कंपनी लेकर आया हूं |

जहां से आप घर बैठे ले सकते हैं instant loan online |

जो कंपनी आज हम आपके लिए लेकर आए हैं उस कंपनी का नाम है BUDDY LOAN |

जी हां दोस्तों आप बड़ी लोन से घर बैठे पर्सनल लोन के लिए अप्लाई कर सकते हैं यहां पर आपको मिल सकता है 1500000 रुपए तक का लोन |

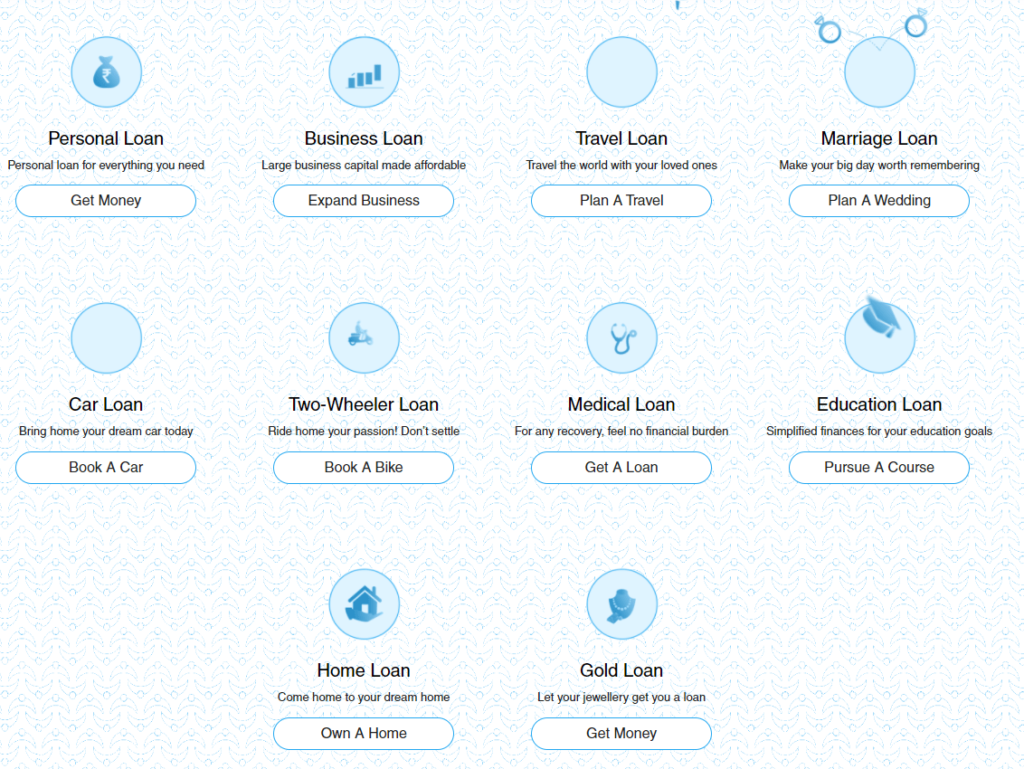

LOAN TYPE

आपको यहां पर 10 तरह के लोग मिलते हैं |

LOAN TENURE

आपको यहां पर कम से कम ₹1000 का लोन और ज्यादा से ज्यादा ₹1500000 तक का लोन मिल सकता है|

यह लोन आपको मिल सकता है | 6 महीने से लेकर 5 साल तक के लिए |

जितना भी लोन आप लेते हैं उस लोन पर आपका ब्याज 11.99% pa शुरू होता है |

Quick Sanction

एक बार लोन अप्रूवल मिलने के बाद आपकी लोन अमाउंट आपके बैंक अकाउंट में 48 घंटे के अंदर ट्रांसफर कर दी जाती है |

यह लोन हम किस लिए ले सकते हैं

- Travel

- Wedding

- Employed with an MNC, public or private company, or self-employed.

- Medical emergencies

- Home renovation

- Higher education

Online personal loan starting @11.99% pa.

Buddy Loan instant personal loan – Min salary required is Rs.20K

Apply Now

Quick Personal loan – Get instant money at low-interest rate from a pool of lenders.

Quick & Easy Personal loans are collateral free money with flexible repayment tenures. The competitive interest rates & high approval rates are unique features of online personal loan.

It can help you assess your financial crunch with a temporary solution. Serves as fast cash under medical emergencies, travel purposes, to bear marriage expenses & spend on overseas education etc. The leading Banks & Non-Banking Financial Companies (NBFCs) disburse loans at attractive interest rates. High-demand in personal loans has made the journey seamless.

Personal loan highlights:

Quick Loan Approval: Make use of the opportunity to meet lenders from different financial firms (banks & NBFCs). With the multiple lenders on one platform, there is less room for delay in personal loan approval.

Minimal & swift documentation: Loan approval is easier & quicker with the right set of documents. The process requires minimal document set & could marginally vary from lender to lender depending on your personal loan requirements.

Collateral-free loans: Quick Personal loans do not need any asset to mortgage for loan approval. It aggregates lenders and borrowers’ details for better loan transparency.

Flexible repayment options: Easy Personal loans with open – end repayment tenures are available. Choose your loan repayment type & tenure here. (ranges between 3 months to 5 years)

Competitive interest rates: Unsecured personal loans have high approvals in less time. If you share a decent credit history, you can avail a loan at lower interest rates starting at 11.99% pa.

High Approval Rates & Safety: Enhance credibility with an online personal loan at high approval rates. The API platform is breach free from any illegal or unauthorized practice. It is completely safe.

Get Instant Assistance: You can seek assistance on multiple EMIs, queries & concerns, transactions, loan tenure, pre & post-payment, acknowledgement through our Buddy Loan support team.

Personal loan documents & eligibility:

Proof of identity & address – For Quick personal loan approvals, you can submit your Aadhaar card & PAN card. However, Voter ID, passport & driver’s license work as well. Proof of income – 3 consecutive months’ salary slip with the present organization or business can serve as income proof for a personal loan. Please note, the set of documents may vary marginally from lender to lender.

The personal loan bracket is eligible for any salaried and self-employed:

- Preferrable age group of 24 & 60.

- Basic income of 20k & above, ae eligible for an online personal loan.

- Can be salaried or self-employed get a personal loan of minimum amount (Rs. 10,000) & maximum of (Rs. 15,00,000)

- Buddy Loan services are available in major cities & towns across India

- Provide last 3 months’ salary-slips/ relative income proof documents. Should support the current income criteria.

- Have a decent CIBIL score between (700 – 900).

- If you have an excellent credit history, you can accelerate the loan approval process at lower interest rates.

Personal loan can be availed for any need and expense. It can help you manage the expenses of a variety of financial needs including:

Pingback: Insta Credit - Apply the Loan Today and Get the Approval 24 hours! - NDP Financial News

Pingback: Instant Personal Loan with Low Credit Score | Online Loan Apply - NDP Financial News